Preface

Welcome to Economic Facts and Fallacies, a thought-provoking exploration of widespread economic misconceptions․ This book challenges readers to rethink common beliefs about wealth, inequality, and societal trends, backed by data and logic․

Welcome to Economic Facts and Fallacies, a compelling examination of widely held beliefs about economics․ This book challenges readers to question common assumptions about wealth, inequality, and societal trends․ By examining six key areas—urbanization, gender, race, higher education, and international economics—Thomas Sowell reveals how misconceptions often shape public opinion and policy․ Using empirical evidence, historical context, and logical reasoning, Sowell debunks myths while shedding light on overlooked realities․ This introduction sets the stage for a journey into the complexities of economic thinking, encouraging readers to approach these topics with a critical and informed perspective․ The goal is to foster a deeper understanding of how facts and fallacies intersect in shaping our economic world․

1․2․ Purpose of the Book

The primary aim of Economic Facts and Fallacies is to clarify common misunderstandings about economic issues․ By presenting clear, evidence-based arguments, the book seeks to empower readers with a more accurate understanding of key topics․ It addresses myths perpetuated by media and policymakers, offering a corrective lens through which to view urbanization, gender disparities, racial differences, and international economics․ The book’s purpose is not only to debunk fallacies but also to highlight overlooked facts that are essential for informed decision-making․ Through this approach, Thomas Sowell aims to foster critical thinking and provide readers with tools to evaluate economic claims more effectively, ultimately contributing to better public discourse and policy formation․

1․3․ Overview of Key Themes

Economic Facts and Fallacies delves into six core areas, each addressing prevalent economic misconceptions․ The book examines urban economics, challenging myths about city growth and housing markets, while also exploring gender and racial disparities․ It critiques the notion of a persistent gender pay gap and analyzes income inequalities among races․ Additionally, the book investigates the economics of higher education, questioning the value of rising tuition costs and student debt․ Finally, it ventures into international economics, discussing global poverty trends and the role of trade in economic development․ Through these themes, the book provides a comprehensive analysis of economic fallacies, equipping readers with a clearer understanding of complex issues․

Chapter 1: The Power of Fallacies

This chapter examines how logical fallacies shape economic reasoning and policy decisions, often misleading both the public and policymakers with simplistic or flawed assumptions about wealth and markets․

2․1․ Common Logical Fallacies in Economic Reasoning

Logical fallacies frequently distort economic discussions, leading to flawed conclusions․ One prevalent fallacy is conflating correlation with causation, where coincidental patterns are mistaken for causal relationships․ Another is the fallacy of composition, assuming individual behaviors apply to entire economies․ Ignoring trade-offs is also common, as policymakers often focus on one benefit while overlooking associated costs․ Additionally, the zero-sum fallacy misleads people into believing economic gains for one group must come at others’ expense․ Thomas Sowell highlights these and other fallacies, emphasizing how they misguide public perception and policy decisions, often with detrimental consequences․ Recognizing these errors is crucial for sound economic reasoning․

2․2․ The Role of Fallacies in Shaping Economic Policies

Economic fallacies often influence policy decisions, leading to unintended consequences․ Policymakers may rely on flawed assumptions, such as the belief that price controls reduce poverty, ignoring how they disrupt markets․ Fallacies like the zero-sum mindset—assuming one group’s gain must equal another’s loss—shape restrictive trade policies, stifling innovation․ The anecdotal fallacy also skews decisions, as emotional stories replace broader data․ Such missteps highlight the need for critical analysis in policymaking to ensure decisions are grounded in evidence rather than misconception․ Thomas Sowell emphasizes how these fallacies distort policy outcomes, urging a more fact-based approach to economic governance․

2․3․ How Fallacies Mislead the Public and Policymakers

Economic fallacies often distort public perception and misguide policymakers by oversimplifying complex issues․ For instance, the zero-sum fallacy leads people to believe that wealth is fixed, ignoring how trade creates value․ The anecdotal fallacy prioritizes emotional stories over statistical evidence, skewing policy decisions․ Fallacies like the fallacy of composition assume individual experiences reflect broader trends, leading to flawed conclusions․ These misconceptions result in policies that inadvertently harm the economy, such as rent controls exacerbating housing shortages․ By misunderstanding cause-and-effect relationships, both the public and policymakers may endorse solutions that worsen the problems they aim to solve, highlighting the urgent need for critical thinking in economic analysis․

Chapter 2: Urban Facts and Fallacies

- Chapter 2: Urban Facts and Fallacies explores myths about urbanization, housing markets, and urban poverty, revealing how misconceptions shape policies and public perceptions․

3․1․ Myths About Urbanization and City Growth

Urbanization is often misunderstood, with myths claiming it leads to inevitable decline and dysfunction․ However, historical data shows cities drive economic growth and innovation․ For instance, the idea that population growth automatically causes poverty is debunked by examples like 19th-century New York, where urban expansion coincided with rising living standards․ Another myth is that cities are inherently less sustainable than rural areas, yet density often reduces per-capita resource use․ These fallacies ignore how urban centers foster specialization, technological advancement, and cultural progress, highlighting the need for nuanced perspectives on city growth and development․

3․2․ The Economics of Housing Markets

Housing markets are often subject to misconceptions, such as the belief that increasing supply always lowers prices․ In reality, demand dynamics, zoning laws, and economic policies play crucial roles․ For instance, luxury developments may not address affordability for low-income groups․ Another fallacy is that rent control helps tenants, yet it often reduces incentives for new construction, worsening shortages․ Economic principles like supply and demand are distorted by government interventions, leading to inefficiencies․ Understanding these factors is key to crafting effective housing policies that balance affordability and market sustainability, ensuring equitable access to housing without stifling economic growth or innovation in urban areas․

3․3․ Urban Poverty and Income Disparities

Urban poverty and income disparities are often misunderstood due to oversimplification․ While systemic factors like discrimination and unequal access to resources contribute, other dynamics, such as family structure and cultural norms, also play a role․ For instance, poverty rates among intact families are significantly lower than in single-parent households․ Additionally, policies intended to alleviate poverty can sometimes perpetuate dependency rather than foster self-sufficiency․ Sowell argues against blanket solutions, emphasizing the complexity of urban economic challenges․ He highlights how misconceptions about income inequality ignore the dynamic nature of earnings over lifetimes․ Addressing urban poverty requires a nuanced approach that considers both structural barriers and individual agency, ensuring policies empower rather than entrench disadvantaged groups․

Chapter 3: Male-Female Facts and Fallacies

This chapter examines economic differences between genders, challenging stereotypes about earnings and employment․ It reveals how occupational choices and social dynamics influence income disparities, beyond discrimination․

4․1․ Gender Differences in Earnings and Employment

Genders exhibit notable differences in earnings and employment across various industries, often attributed to occupational choices, work hours, and career interruptions․ While discrimination is frequently cited, data reveal that factors like voluntary career decisions and family responsibilities significantly influence these disparities․ For instance, women may opt for lower-paying but more flexible roles to balance family life․ Similarly, men often pursue higher-risk, higher-reward jobs․ These patterns highlight how economic outcomes are shaped by a complex interplay of personal choices, societal norms, and market dynamics, rather than solely by discrimination․ Understanding these nuances is crucial for crafting policies that address genuine inequities without oversimplifying the issue․ Economic data underscores the need for a balanced perspective in addressing gender disparities․

4․2․ Occupational Distribution and Career Choices

The distribution of men and women across occupations is influenced by a variety of factors, including personal preferences, societal norms, and structural barriers․ While some argue that gender-based discrimination drives these disparities, evidence suggests that voluntary career choices play a significant role․ Women often gravitate toward fields like education and healthcare, which align with caregiving roles, while men dominate industries such as engineering and construction․ These patterns are shaped by differences in risk tolerance, work-life balance preferences, and perceived job satisfaction․ Understanding these dynamics is essential for addressing occupational imbalances without oversimplifying the complexities of individual decision-making․ Policymakers must recognize the interplay of personal and systemic factors in shaping career outcomes․

4․3․ The Gender Pay Gap Debate

The gender pay gap debate often centers on the statistic that women earn less than men for the same work․ However, this figure is frequently misinterpreted, as it does not account for differences in career choices, hours worked, or job experience․ While raw data shows disparities, adjusted data reveals smaller gaps when controlling for these factors․ Critics argue that systemic discrimination is less pervasive than often claimed, with many pay differences stemming from voluntary choices․ Thomas Sowell highlights how simplistic narratives about gender discrimination overlook the complexity of labor market dynamics․ Addressing this issue requires a nuanced understanding of both structural barriers and individual preferences․ Policymakers must distinguish between unequal pay for equal work and unequal choices that lead to different outcomes․

Chapter 4: Racial Facts and Fallacies

This chapter examines racial disparities in income, wealth, education, and crime, challenging common perceptions․ It emphasizes the importance of interpreting data within proper economic and social contexts․

5․1․ Income and Wealth Disparities Among Races

Economic disparities among races remain a significant issue, with income and wealth gaps persisting across different racial groups․ Factors such as historical discrimination, educational access, and systemic inequalities contribute to these disparities․ Data shows that, on average, certain racial groups have lower per capita incomes and less accumulated wealth compared to others․ For instance, the poverty rate among Black married couples has historically been lower than commonly perceived, highlighting the importance of understanding nuanced economic realities․ These disparities are often misrepresented in public discourse, leading to misguided policies․ Addressing these issues requires a deeper understanding of the complex interplay between race, economics, and social structures․

5․2․ Educational and Occupational Achievements

Educational and occupational achievements vary significantly across racial groups, influenced by historical, social, and economic factors․ While some groups have made strides in education and career advancement, others face persistent challenges․ For instance, certain racial groups are underrepresented in high-paying professions, while others may experience barriers to educational access․ These disparities are often misrepresented in public discourse, with misconceptions about meritocracy and equal opportunity․ The book emphasizes the need to critically examine these patterns, focusing on how systemic inequalities shape outcomes rather than individual merit alone․ Understanding these dynamics is crucial for crafting policies that address the root causes of racial disparities in education and employment․

5;3․ Crime Statistics and Racial Perceptions

Crime statistics are often misrepresented to fuel racial stereotypes, leading to misguided perceptions about crime and race․ Media and political rhetoric frequently amplify these misconceptions, creating a distorted public image․ In reality, crime rates are influenced by socioeconomic factors rather than race․ For instance, poverty and lack of opportunities disproportionately affect certain communities, leading to higher crime rates․ However, these underlying causes are often overlooked in favor of simplistic racial narratives․ The book highlights how such fallacies perpetuate harmful stereotypes and misguided policies, emphasizing the need for a nuanced understanding of crime rooted in economic and social realities rather than race․ This misrepresentation has far-reaching consequences for racial relations and policy decisions․

Chapter 5: Higher Education Facts and Fallacies

This chapter examines the economic realities of higher education, challenging common myths about tuition costs, student debt, and the return on investment in education․

6․1․ The Economic Impact of Higher Education

The economic impact of higher education is profound, influencing both individuals and society․ Colleges and universities drive innovation, foster skilled labor, and stimulate local economies through job creation and research․ However, critics argue that the rising cost of tuition and increasing student debt may outweigh these benefits․ Despite this, studies show that individuals with higher education typically earn higher wages and experience lower unemployment rates․ Moreover, societies with robust higher education systems often see improved economic growth and competitiveness․ This section delves into the multifaceted role of higher education in shaping economic outcomes and its broader societal implications․

6․2․ Tuition Costs and Student Debt

Rising tuition costs and mounting student debt have sparked significant debate about the affordability of higher education․ Over the past few decades, college tuition fees have outpaced inflation, leading to a surge in student loans․ While many argue that higher education is a valuable investment, others point to the financial burden it places on graduates․ This section examines the trends behind increasing tuition costs, the implications of growing student debt, and the potential consequences for individuals and the economy․ It also explores whether the benefits of higher education justify the rising financial costs and debt obligations for students․

6․3․ The Relationship Between Education and Earnings

Education is often viewed as a key driver of higher earnings, but the relationship between the two is more complex than commonly perceived․ While data shows that individuals with higher levels of education tend to earn more, this correlation does not always imply causation․ Factors such as individual ability, family background, and career choices also play significant roles․ This section delves into the nuances of how education influences earnings, examining the variations across different fields of study and the long-term financial benefits of investing in higher education․ It also discusses whether the earning potential of a degree aligns with its cost and debt burden․

Chapter 6: International Economic Facts and Fallacies

This chapter examines global economic myths, focusing on income disparities, trade impacts, and living standards across nations․ It challenges common misconceptions about international economic trends and development․

7․1․ Per Capita Income and Global Poverty

Despite global progress in reducing poverty, misconceptions about per capita income and wealth distribution persist․ Many believe poverty is stagnant, but data show significant declines in global poverty rates over the past century․ However, disparities remain, with some regions lagging behind․ Policymakers often overlook the complexities of per capita income measurements, which can mask inequality within nations․ Media narratives frequently emphasize absolute poverty numbers without context, ignoring improvements in living standards․ This chapter examines how these myths shape international aid strategies and economic policies, often leading to misguided interventions․ Understanding the nuances of global poverty is crucial for effective solutions․

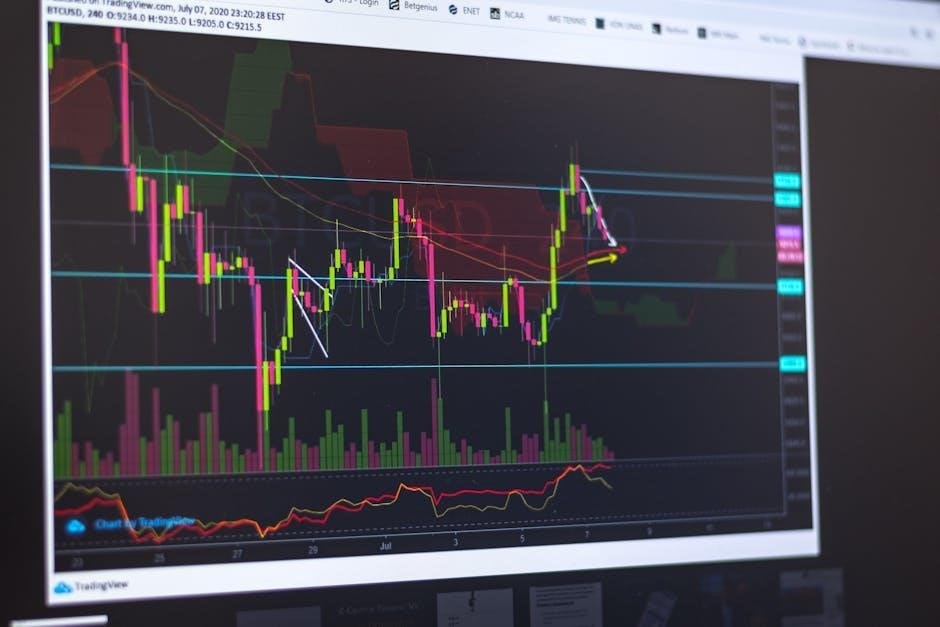

7․2․ International Trade and Economic Growth

International trade is often misunderstood as a zero-sum game, where one country’s gain equals another’s loss․ In reality, trade fosters economic growth by allowing nations to specialize and innovation․ Fallacies about trade deficits being harmful are debunked by historical evidence showing deficits can coincide with prosperity․ Protectionist policies, justified by misconceptions, often harm consumers and stifle competition․ This chapter explores how trade drives productivity, increases consumer choices, and promotes global economic interdependence․ By examining real-world examples, it reveals how misconceptions about trade lead to counterproductive policies, highlighting the importance of open markets for sustained growth and development․ Trade is not a competition but a collaboration for mutual benefit․

7․3․ The Convergence of Living Standards Across Nations

The idea that living standards across nations are converging is a popular belief, yet it remains largely unfulfilled․ While some developing economies have made remarkable progress, others lag behind․ Fallacies arise from assuming that globalization automatically leads to equal outcomes․ Historical data shows that convergence is not inevitable; it depends on institutional frameworks, policies, and cultural factors․ This chapter examines why some nations thrive while others stagnate, challenging the notion of inevitable global equality․ It highlights how economic policies, education, and political stability influence convergence, emphasizing that living standards are shaped by more than just economic exchange․ True convergence requires comprehensive reforms and international cooperation․

This book concludes by summarizing key economic truths and debunking persistent fallacies․ It emphasizes the importance of critical thinking in understanding economic realities and formulating effective policies․

By challenging common misconceptions, it equips readers to make informed decisions and engage in meaningful discussions about economic issues․ The final chapter reinforces the need for evidence-based reasoning

in addressing societal challenges, ensuring a clearer path toward prosperity and equality․ Critical thinking is essential for navigating complex economic landscapes and avoiding misleading narratives․

Ultimately, this conclusion underscores the enduring relevance of economic facts in shaping a better future․

8․1․ Summary of Key Findings

This book systematically examines common economic misconceptions, providing clarity on topics like urbanization, gender disparities, and racial economics․ It debunks myths surrounding income inequality,

highlighting often-overlooked facts such as the poverty rate among black married couples․ Sowell challenges prevailing narratives, emphasizing the role of incentives and trade-offs in economic decisions․

The analysis spans urban housing markets, higher education, and international trade, revealing how fallacies mislead policymakers and the public․ By separating fact from fiction, the book offers a

comprehensive understanding of economic realities, encouraging readers to think critically about complex issues․ Its accessible style and real-world examples make it an invaluable resource for anyone seeking to

grasp the fundamentals of economics and its societal implications․ The findings underscore the importance of evidence-based reasoning in addressing global economic challenges․

8․2․ Implications for Economic Policy

The findings in Economic Facts and Fallacies have significant implications for policymaking․ By identifying and challenging widespread economic misconceptions, the book advocates for policies grounded in empirical evidence rather than misguided assumptions․ For instance, addressing urban housing markets requires understanding supply and demand dynamics, while gender and racial disparities call for policies that promote equal opportunities without ignoring underlying complexities․ The book also highlights the importance of international trade in reducing global poverty and the need to reassess higher education’s role in economic mobility․ Policymakers must prioritize fact-based reasoning to avoid perpetuating inequalities and ensure sustainable economic growth․

8․3․ The Importance of Critical Thinking in Economics

Critical thinking is essential for understanding economic realities and avoiding fallacies․ By analyzing data objectively and questioning assumptions, individuals can make informed decisions․ Economic Facts and Fallacies emphasizes the need to challenge widely accepted beliefs, such as myths about urbanization or gender pay gaps․ For instance, the book reveals that income disparities are often misinterpreted, and policies based on these misunderstandings can exacerbate problems․ Encouraging a fact-based approach, the book highlights how critical thinking fosters better economic outcomes․ It also underscores the role of education in promoting analytical skills, enabling individuals to navigate complex economic issues effectively․ This mindset is crucial for fostering sound policy and personal financial literacy․